A Promised Relief for Taxpayers

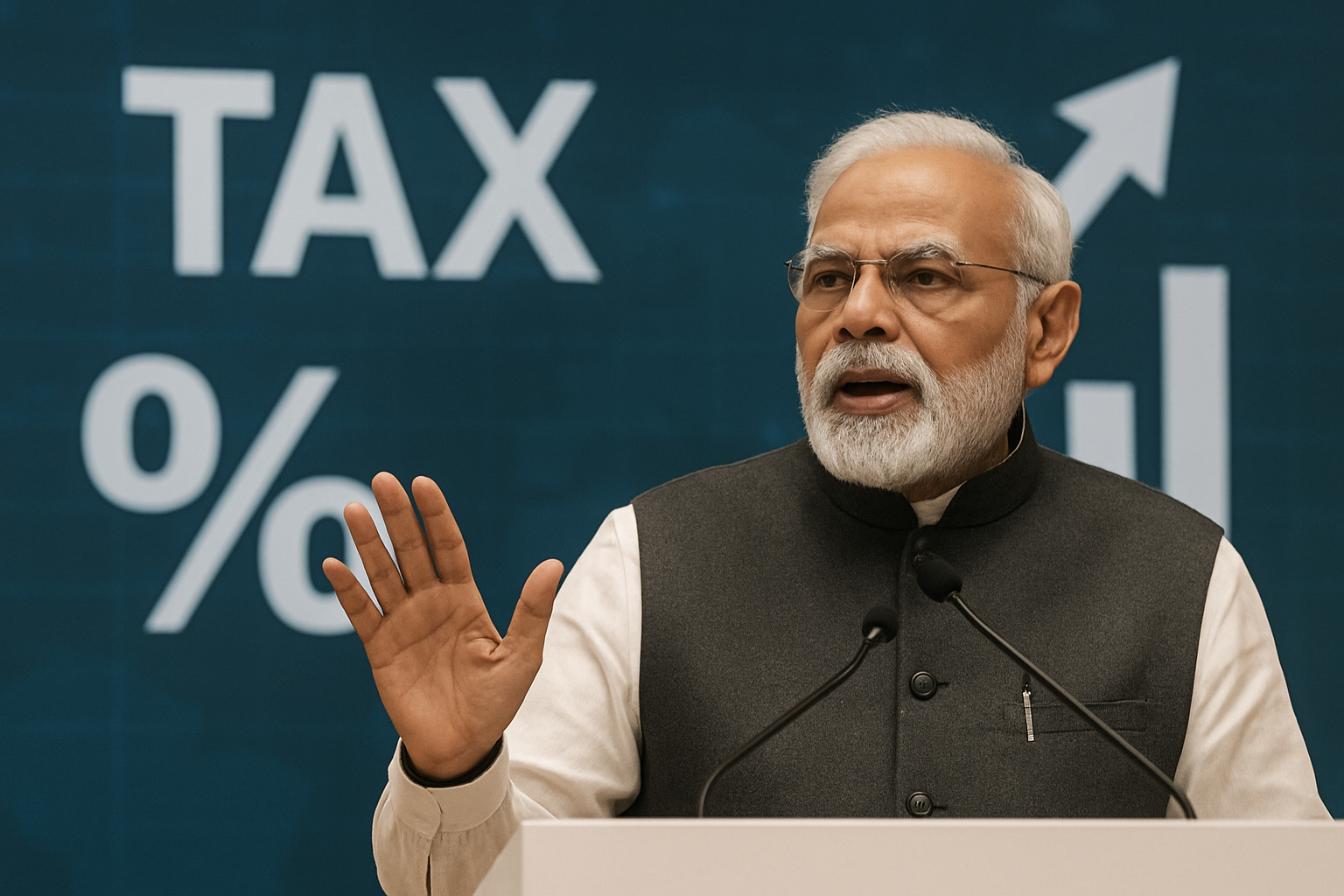

Prime Minister Narendra Modi has assured that as India’s economy gains momentum, the tax burden on citizens will continue to be reduced. Speaking at the inauguration of the UP International Trade Show, he framed upcoming tax policy changes as part of the government’s long-term vision, not just relief measures.

Why This Statement Comes Now

India recently implemented sweeping changes to GST and income tax structures. These reforms aim to simplify the tax regime and ease people’s financial load. In past budgets, policies like exempting incomes up to ₹12 lakh and rationalizing GST slabs were intended to increase disposable income. Modi’s remarks build on that momentum.

Key Highlights of Modi’s Announcement

- He reaffirmed that tax cuts will continue as the economy becomes stronger.

- Modi linked this promise to the government’s recent GST structural reforms, saying they will enhance growth and consumer purchasing power.

- He urged all Indians to support these changes, underscoring that reform is ongoing not a one-time event.

- The PM also tied tax relief to the larger “Make in India” push, calling for stronger domestic manufacturing and innovation to fuel sustainable growth.

Expert Viewpoints & Reactions

Economists see Modi’s remarks as a signal of confidence. By reducing personal and indirect taxes, policymakers are betting on consumption and investment to sustain growth. However, some analysts warn that lowering taxes too far or too fast might put pressure on government revenue and spending on welfare.

GST reforms will continue, PM Modi says, reinforcing that tax cuts aren’t over.

The Significance for Common Citizens

- More disposable income: Lower taxes can free up money for daily needs, savings, or investment.

- Boost to consumer markets: With more spending power, demand in sectors like retail, auto, and housing may accelerate.

- Policy predictability: The assurance of continuing reforms can build trust among investors and businesses.

- Balanced growth: The push for domestic manufacturing alongside tax relief suggests a holistic development path.

What Lies Ahead

- Tax authorities may roll out further rate cuts and simplifications in phases.

- The government could monitor state finances to ensure central cuts don’t overly burden states.

- Future reforms may target compliance ease, reducing litigation, and expanding tax base sustainably.

- Observers will watch carefully for how these assurances translate into actual policy and execution on the ground.

Conclusion

PM Modi’s pledge that the “tax burden will ease further” sends a strong message: India’s tax reforms are a living process, not snapshots in time. If implemented wisely, this approach could balance the twin goals of growth and welfare offering relief today while building economic resilience for tomorrow.